MAIN FACTOR/S INFLUENCING YOUR CURRENT SCORE:

- Improve your score by not using your full credit limit. The proportion of the account balance to your account limit should not be too high.

- How you pay your accounts affect your score. Payment/s should not be due on some of your accounts. Pay your accounts in full on the due date.

- You have applied for numerous accounts within the last 2 years. Lenders may feel that too many accounts will impact your ability to afford the repayments.

BUREAU CREDIT SCORES

What does this mean for you?

- The bureau credit scores differ depending on the bureau used to reflect changes in a consumer’s credit information, as well as to provide better insight into a consumer’s credit standing.

- In general, a credit rating or credit score is an algorithm which takes into account a person’s payment behaviour, total debt, negative listings and enquiries made on their profile.

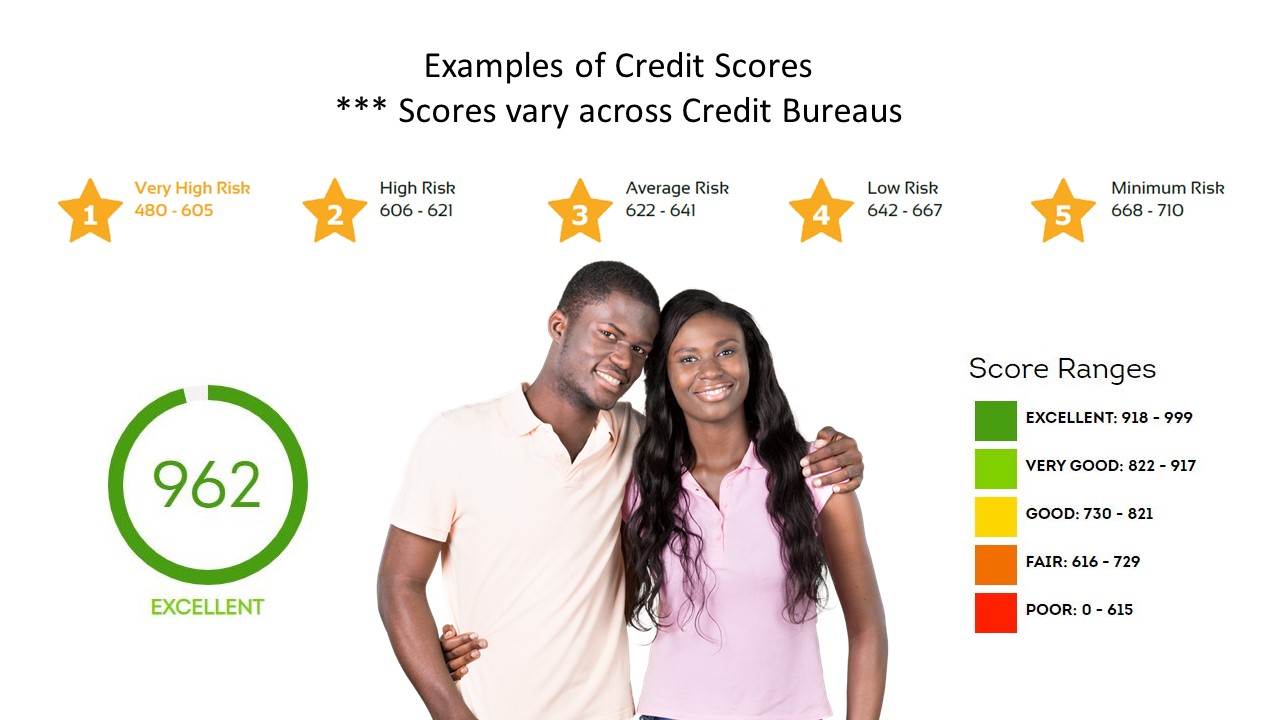

- As an example – at one of the bureaus the score’s range could be between 0 and 999, and score bands could be explained as per the scale on the right.

- Other bureaus might use a star system etc. (We can assist you in understanding your credit score – simply contact us)

GET HELP : CLICK HERE

HOW DO I IMPROVE MY SCORE?

- Manage your accounts: Ensure you pay the full instalment owing on each of your accounts on time, every month. For example, paying half this month and the rest the next month will negatively impact on your score. WE CAN HELP REDUCE INSTALMENTS.

- Limit your amount of debt: Keep the utilisation of your current credit facilities to less than 35 percent of your limit. For example, if you have a credit card with R1000 credit, ensure the balance is under R350 at the end of the month.

- Address negative listings: Check your credit report for items such as judgments and defaults. Take active steps to settle these outstanding debts and ensure you receive your settlement documentation which can be used to clear your credit record. WE CAN HELP WITH THIS.

- Grow your credit history: Maintain a healthy mix of secured versus unsecured credit. For example, store accounts and credit cards versus home loans and vehicle finance. In addition, long-standing credit accounts which are consistently paid on time reflect positively on your credit score.

- Limit your enquiry activity: Try not to shop around too much for credit at the same time. Too many simultaneous applications could indicate that there has been a significant change in your financial circumstances.

Check your credit report – and your credit score – regularly to ensure each consistently paints you in the most accurate and positive light possible.

SOME CREDIT SCORE FAST FACTS

How is your Score Calculated?

- Every credit active consumer has a credit report that is compiled by a credit bureau.

- Usually. your Credit Score is essentially a “numerical summary” of your credit report. All the credit information in your credit report contributes towards the calculation of your credit score.

- Your Credit Score is a number that indicates strengths and weaknesses of the information in your credit report. It shows you how you compare to other consumers when it comes to the way you manage your credit. Your score can improve or deteriorate, depending on your credit behaviour.

- The Credit Score is not an endorsement, or a condemnation, of you or your credit behaviour. It will not determine whether you qualify for credit. That will depend on the credit or service provider’s own criteria. It will however give you a general indication of areas that you may need to improve if you want to qualify for credit.

- The National Credit Act states that a credit or service provider may use its own scoring evaluative mechanism or model to determine who to give credit to. This means that the Credit Score is not the same score that lenders will use to decide if you qualify for credit or a loan. The credit risk score used by lenders will include not only the credit information held by a credit bureau, but also information such as your income and living expenses, your demographic information, current and past relationship with the lender, collateral etc.

- There is no single score or “scoring formula” that’s used all the time by all credit providers. The specific formula a lender chooses is beyond your control. What’s within your control is your ability to handle your credit obligations responsibly each month and take simple steps to keep yourself in good credit standing.

OTHER KEY FACTORS TO CONSIDER WHEN REVIEWING YOUR SCORE:

- Payment history: The way in which you manage your accounts – whether or not the full instalment is paid on time.

- Too much debt: How much you owe and how much available credit is being used. WE CAN HELP WITH THIS.

- Negative information: Information such as bankruptcies and judgments on your credit record. These are items of public record that indicate that you did not honour a particular debt obligation.

- Length of credit history: How long each account has been open.

- Number of new accounts and the number of account enquiries within a short timeframe: How many new accounts are applied for and opened in a short period.

In terms of credit scoring, credit bureaus typically look favorably on established credit accounts. Maintain and manage your accounts responsibly by paying them on time, by the due date. This will reflect positively on the twenty four month payment history that is displayed on the account.